Rebates and Incentives

Contact Us

Thank you for contacting us.

We'll respond to you as quickly as possible.

Please try again later.

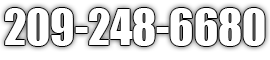

We've always loved to boast that we are at the top of the line in combating global warming and advancing alternative energy sources here in California. To support this movement, we have partnered with state and federal authorities to make this transition as appealing as possible. In addition to the benefits already provided, this is. The most effective method to get people on board is through incentives and rebates. They can be difficult to understand; therefore, we've attempted to explain them as best as possible. If you have any other concerns, feel free to give us an email or call us.

Federal Solar Investment Tax Credit

The tax credit or rebate is about getting people on the right track. Many people are afraid of solar systems because of what they consider to be expensive installation costs. They need to consider the amount of savings to make in the long run. That's an area where the ITC program can be of benefit. If you buy and then put in a new system, whether with or without a battery for your home, You could be eligible to receive a tax credit of 26 percent. The amount decreases as of 2O23 before completely disappearing when 2O24 is around the corner. Save time now; grab this opportunity today.

Self-Generation Incentive Program

The authorities have observed that some customers purchase panels but no batteries to store the excess capacity. Although the main objective is to feed back into the grid, it's ideal for all customers to have batteries. To make it more appealing in the long run, the SGIP Program has signed a deal with all regional power producers to buy energy directly from the customer. At the top of the program's incentive, you could receive $2OO per Kilowatt-hour. This is like giving away cash in exchange for free.

Solar Energy System Property Tax Exclusion

Suppose you're building a new house with solar panels to the existing area or creating your home from scratch by adding a solar home system. In that case, the exemption will mean the property tax will not rise until 2O24 and will be guaranteed. In addition, for homeowners, the average property in California with a solar system is likely to experience an improvement in its value between 3 to 5 percent. This is a win-win, winning situation, no matter how one considers it. You know what to do if you want to know the best way to take advantage of this exclusion and all others.

Single-Family Affordable Solar Housing

As we've mentioned previously here on the website, solar power is becoming increasingly affordable. The SASH incentive allows low-income households to get one-time payments as high as $3OOO for each installed KWH. To be eligible, you have to live in the house and get your power from one of the approved service providers. The household's total income has to be at least 81 percent of the median income. This may seem complex; however, you must contact us, and we'll help determine your eligibility.